Footfall Report '25: Retail Enters a Phase of Mature, Purpose-Driven Growth

Physical retail across Europe entered a new phase of maturity in 2025. Following the strong post-pandemic rebound of recent years, growth stabilised, visitor behaviour continued to evolve and performance became increasingly defined by conversion, convenience and experience, rather than sheer footfall volumes.

08.01.2026

Physical retail across Europe entered a new phase of maturity in 2025. Following the strong post-pandemic rebound of recent years, growth stabilised, visitor behaviour continued to evolve and performance became increasingly defined by conversion, convenience and experience, rather than sheer footfall volumes.

These insights come from PFM Intelligence’s Footfall Trend Report 2025, based on anonymised sensor data covering more than 3 billion people across over 2,000 retail and leisure locations in the Netherlands, the United Kingdom and multiple other European markets. By analysing real-world movement data rather than surveys or transactions, the report provides an objective view of how consumers actually use physical destinations.

Footfall stabilises as consumer behaviour shifts

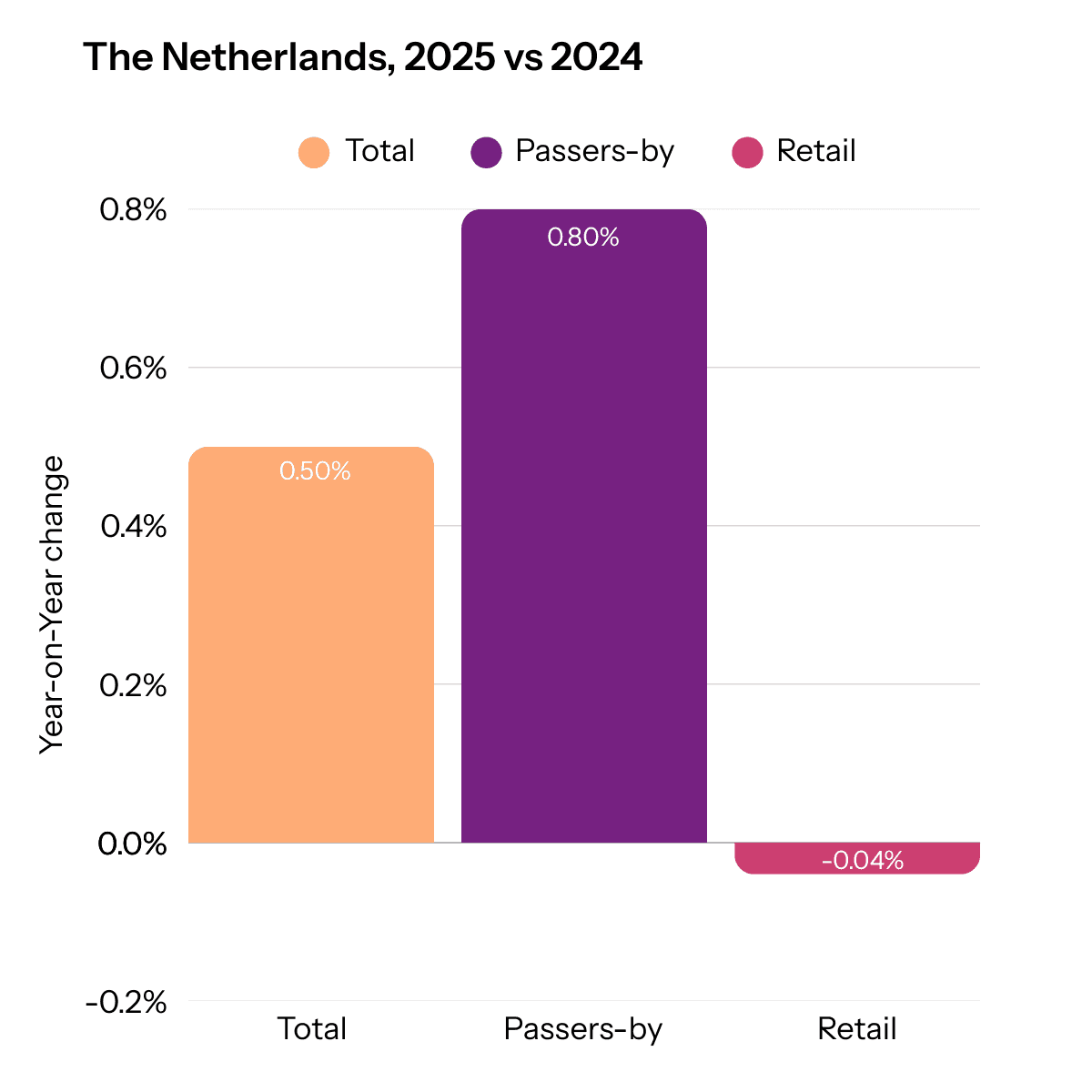

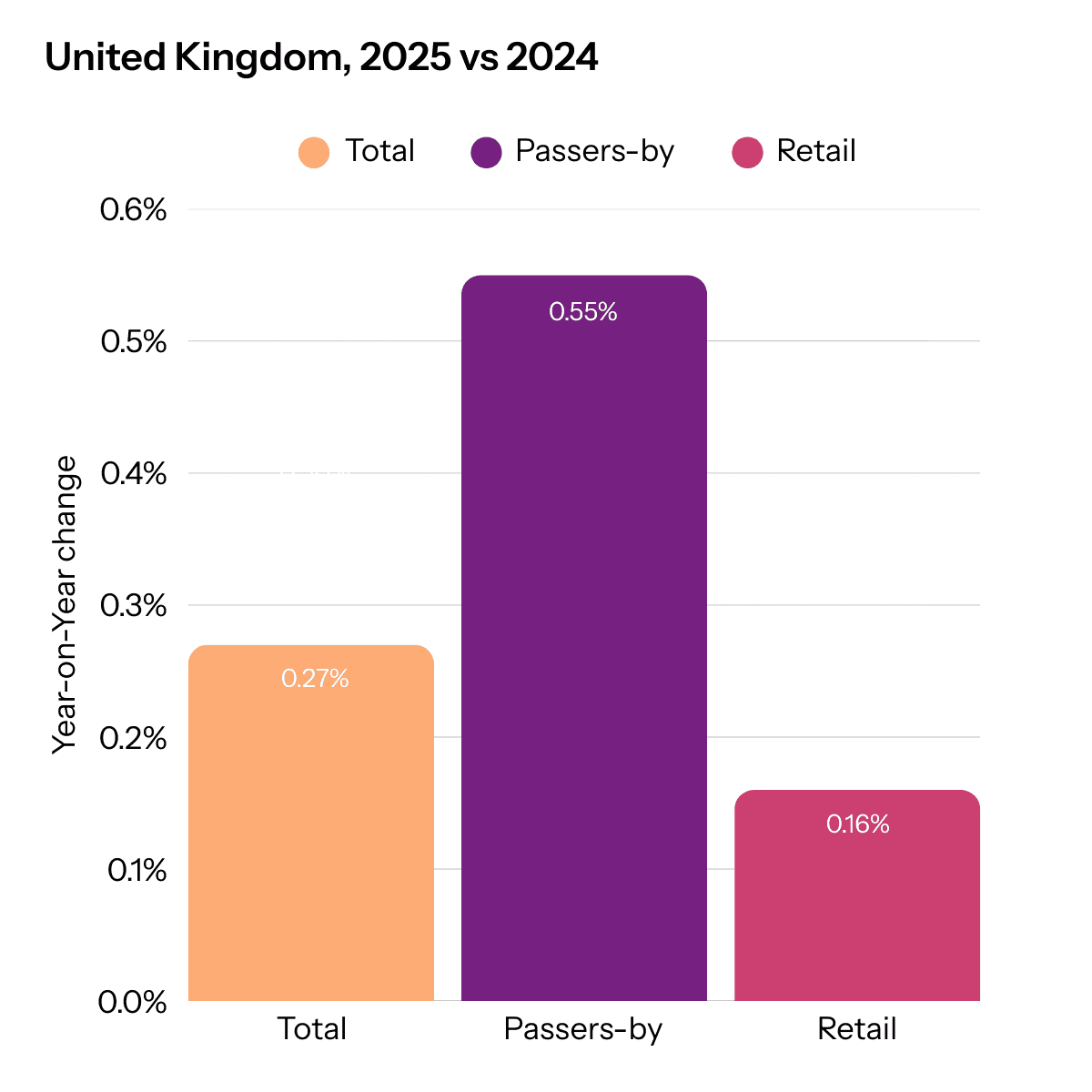

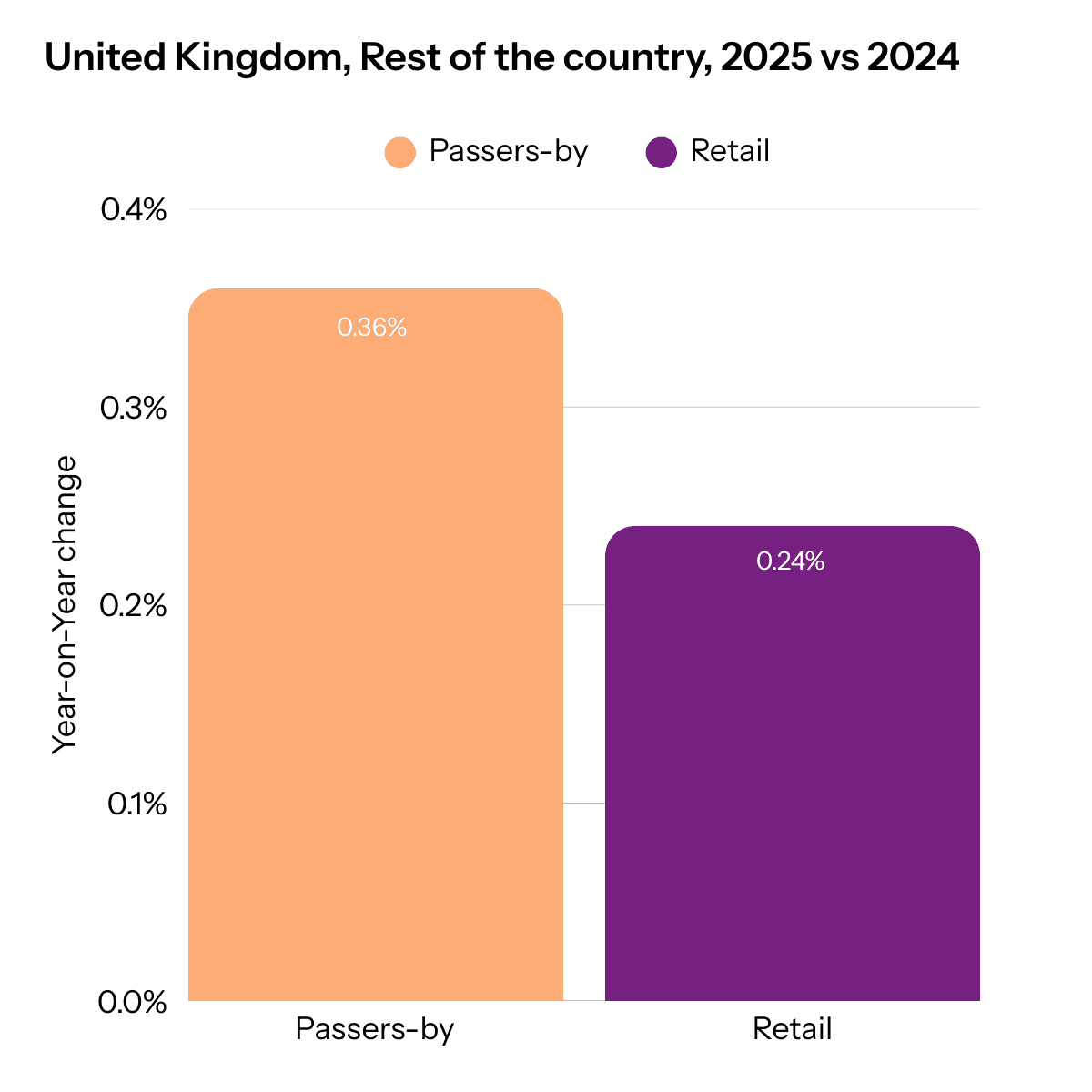

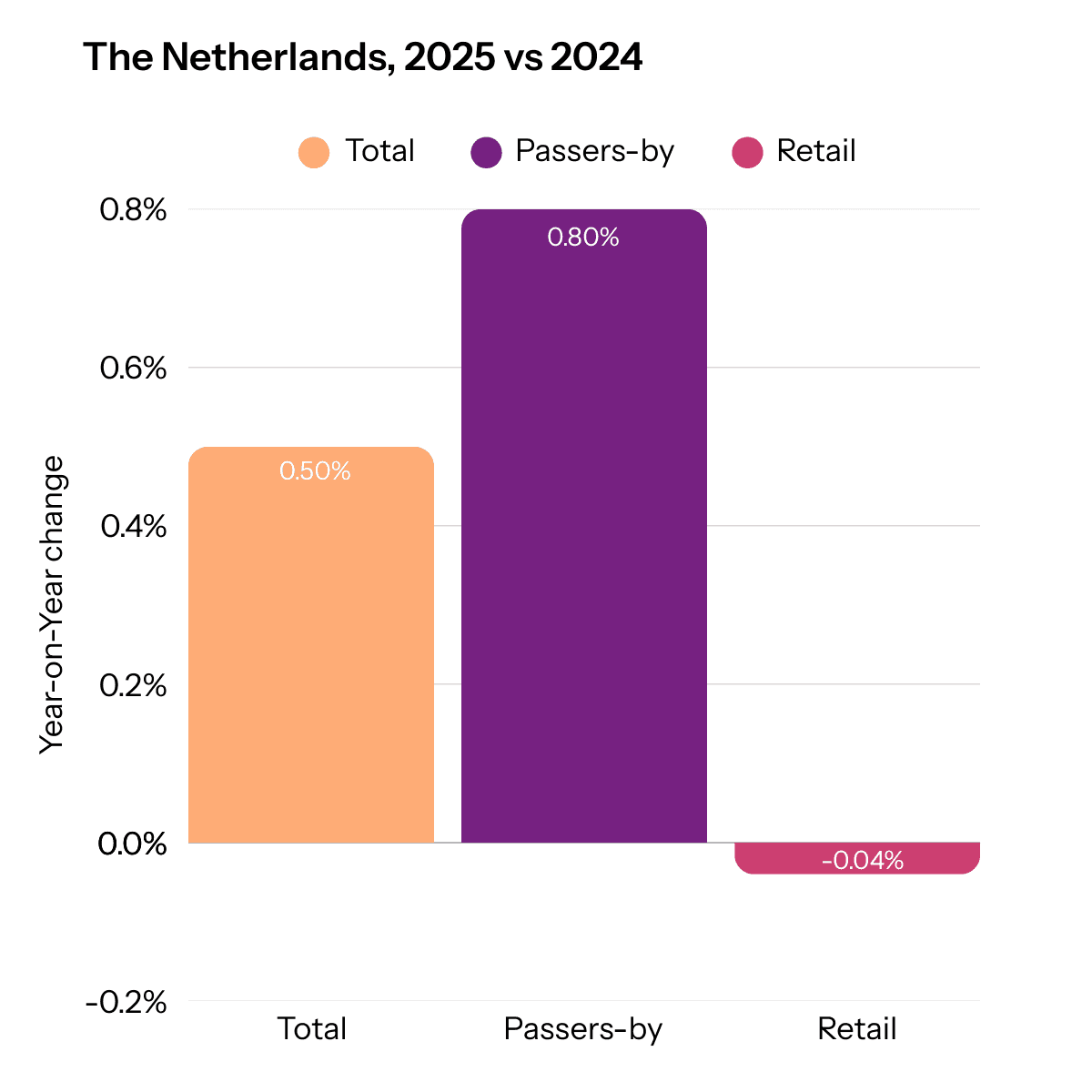

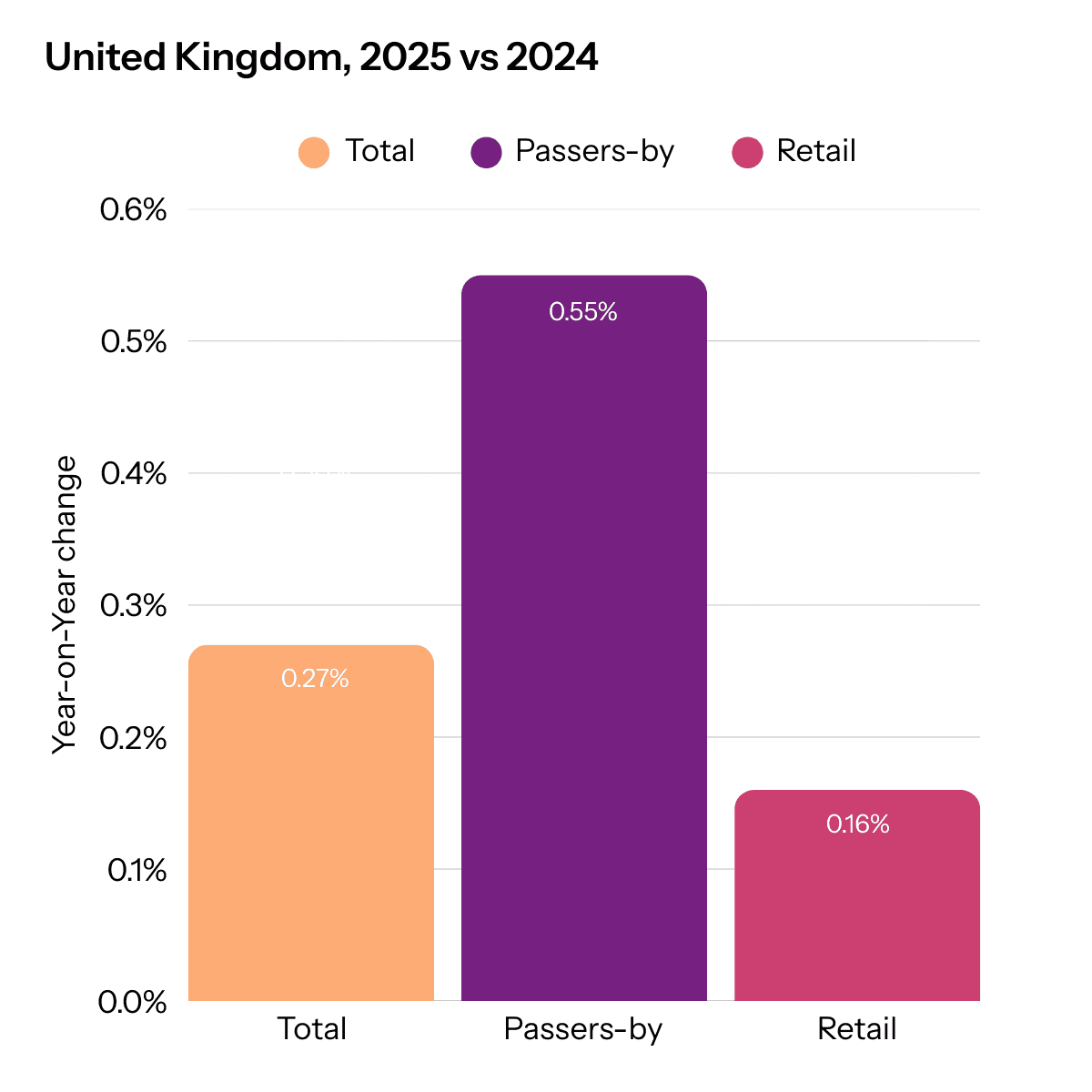

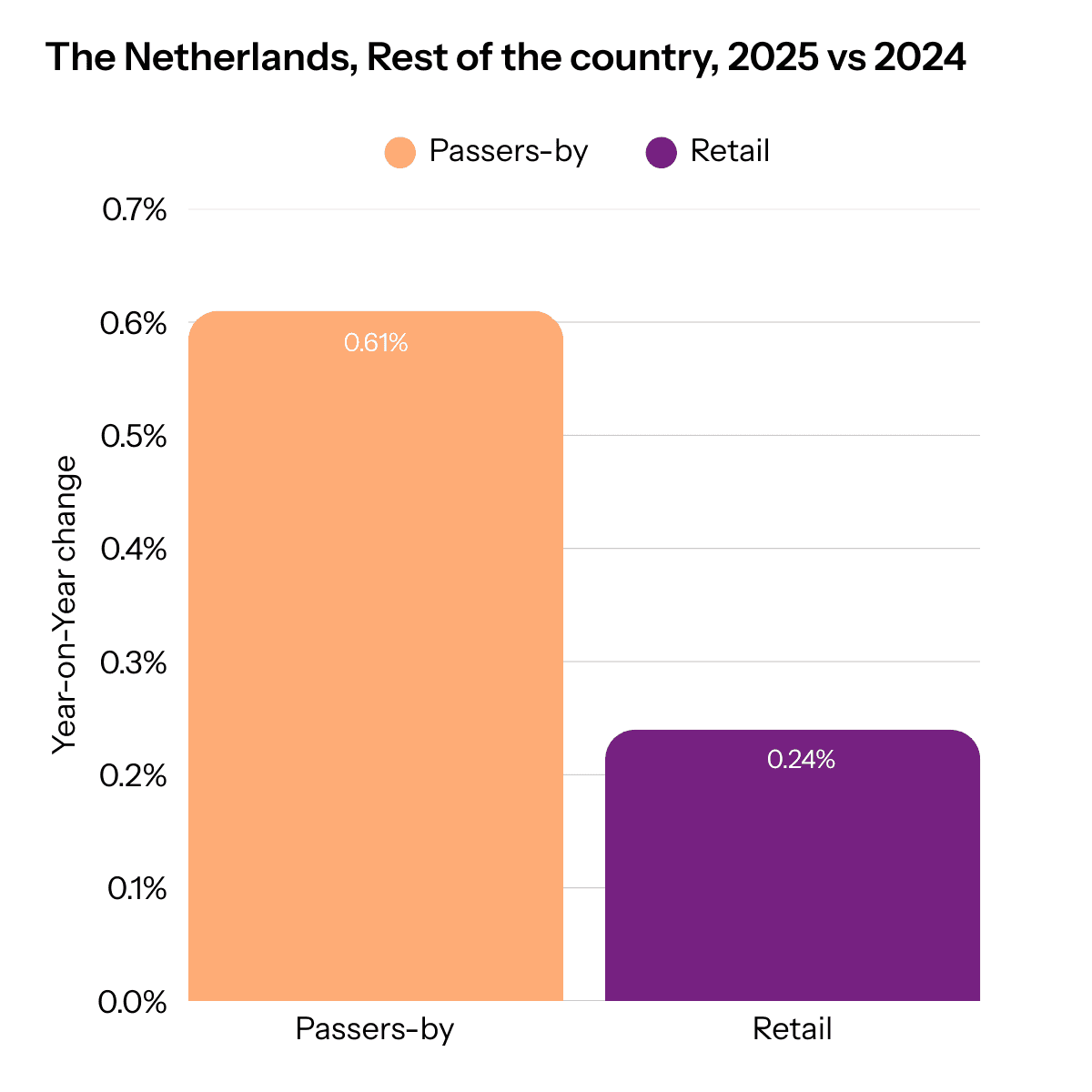

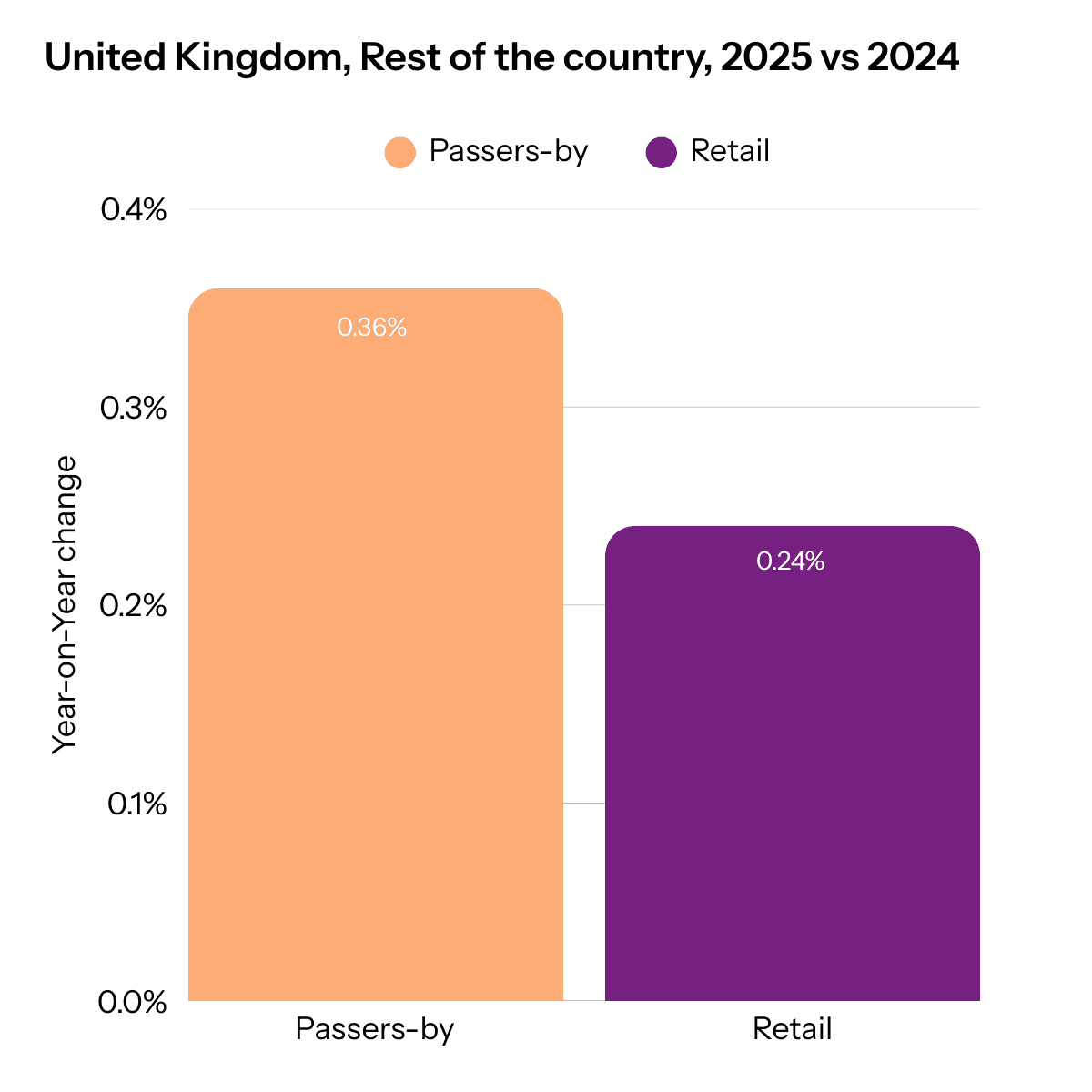

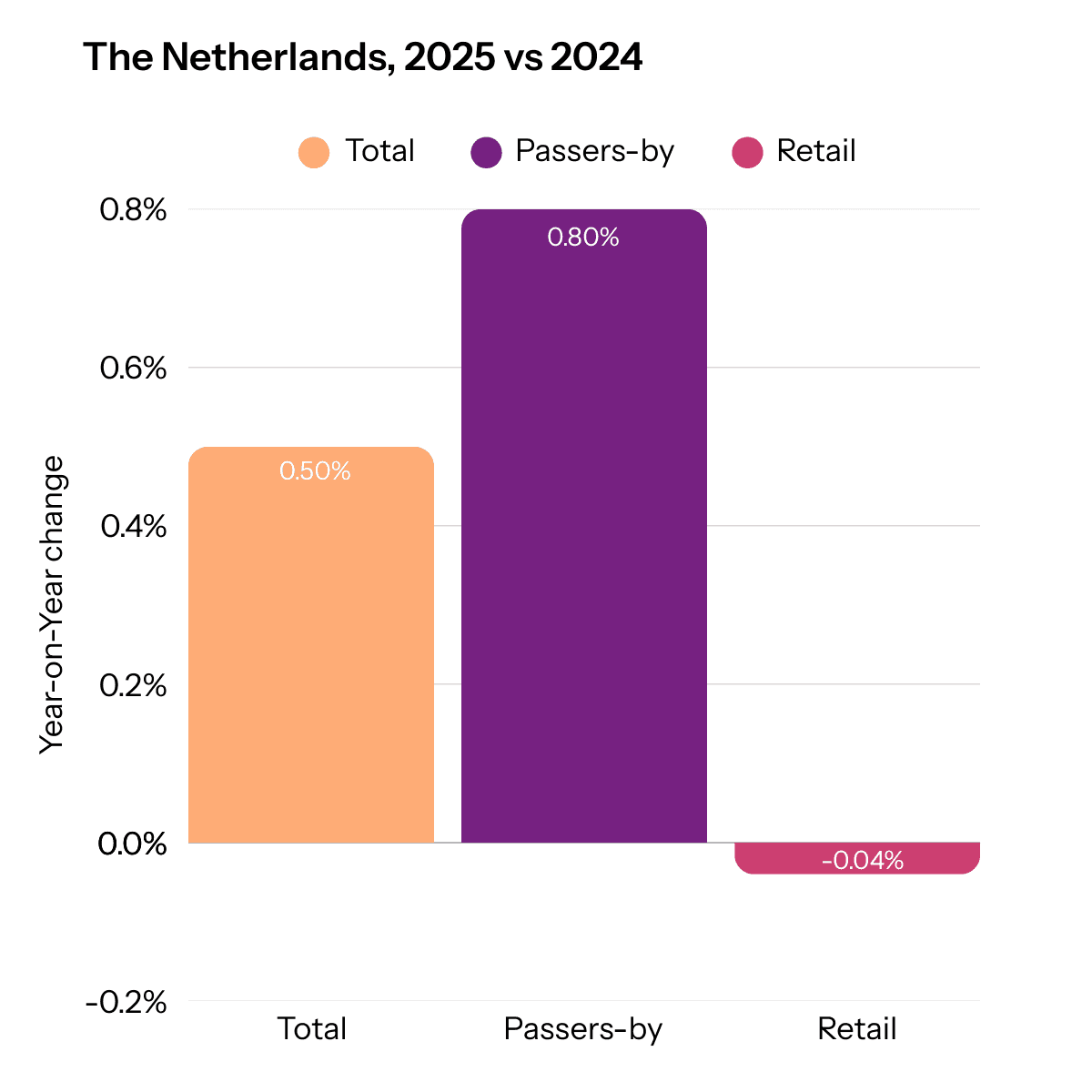

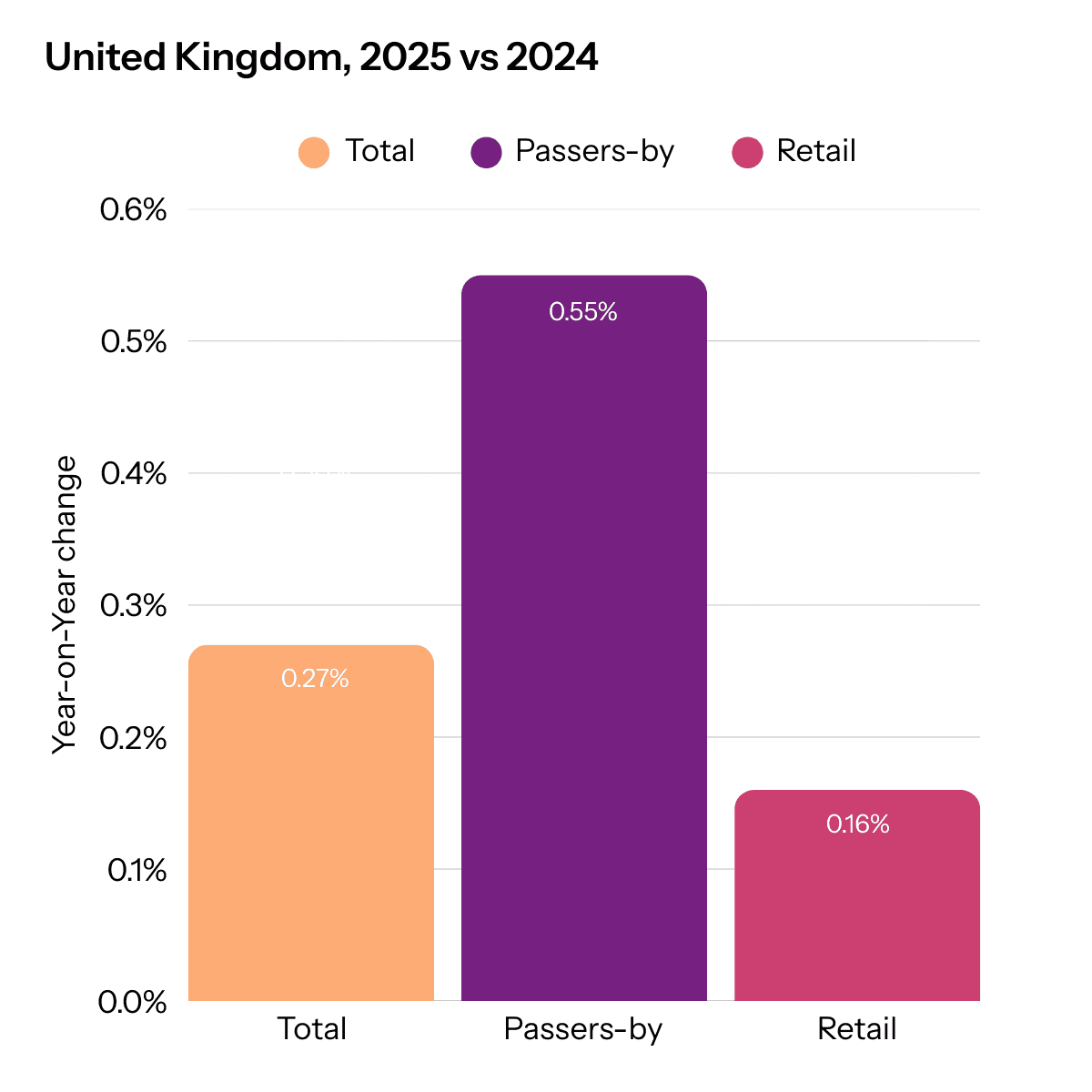

Across both the Netherlands and the UK, total footfall growth remained positive but modest in 2025. In the Netherlands, national footfall increased by 0.50% year-on-year, while the UK recorded a 0.27% increase, signalling a clear shift from recovery to stabilisation.

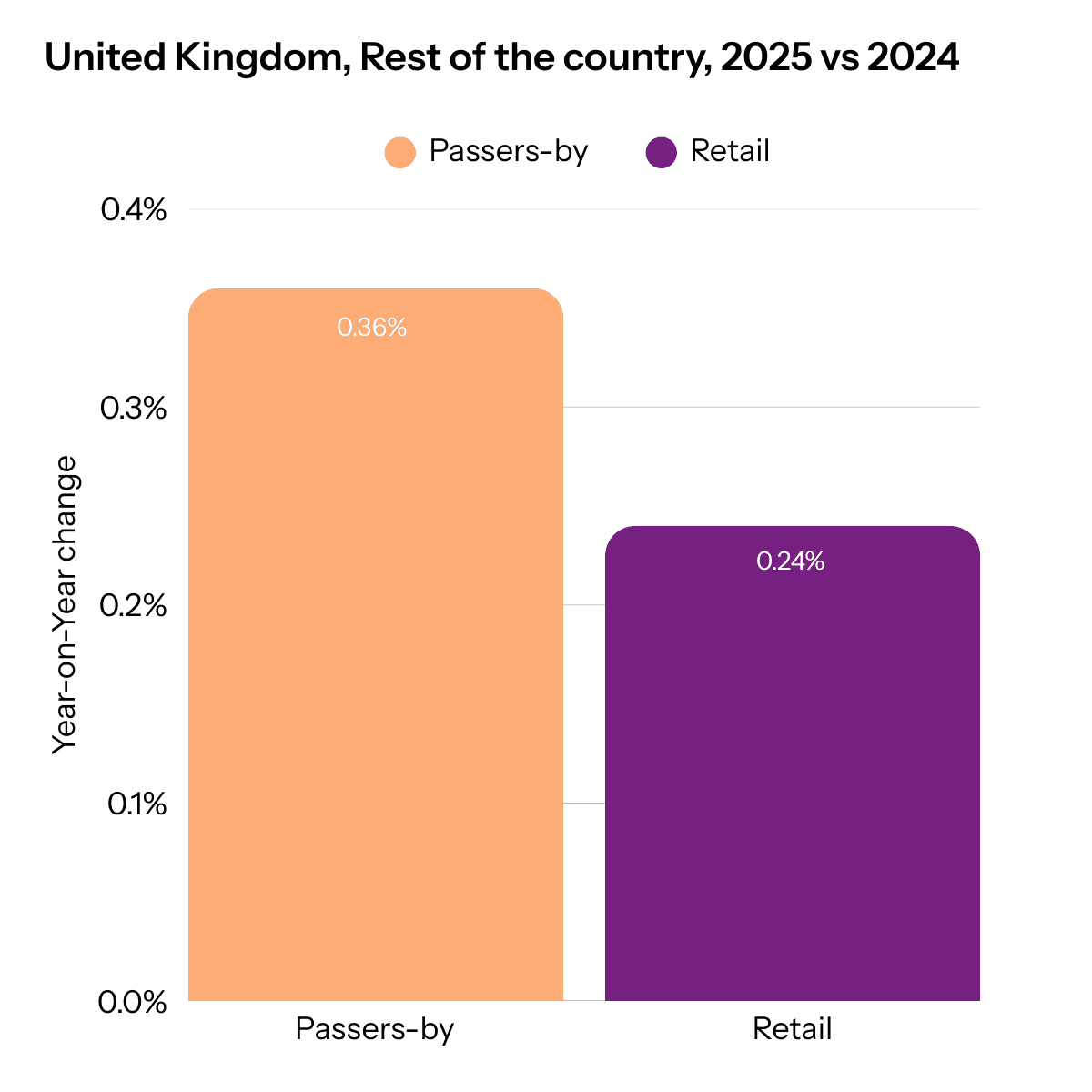

In both markets, passer-by volumes grew faster than retail visits, underlining a widening gap between presence and conversion. Passers-by increased by 0.8% in the Netherlands and 0.55% in the UK, while retail visits were flat to marginally positive (-0.04% in the Netherlands, +0.16% in the UK).

This divergence points to a structural change in shopping behaviour. Consumers remain active in physical environments, but they visit stores less frequently and with clearer intent, often combining shopping with work, leisure or daily routines. Convenience, proximity and multifunctional destinations are playing an increasingly decisive role.

Big cities attract footfall, but conversion comes under pressure

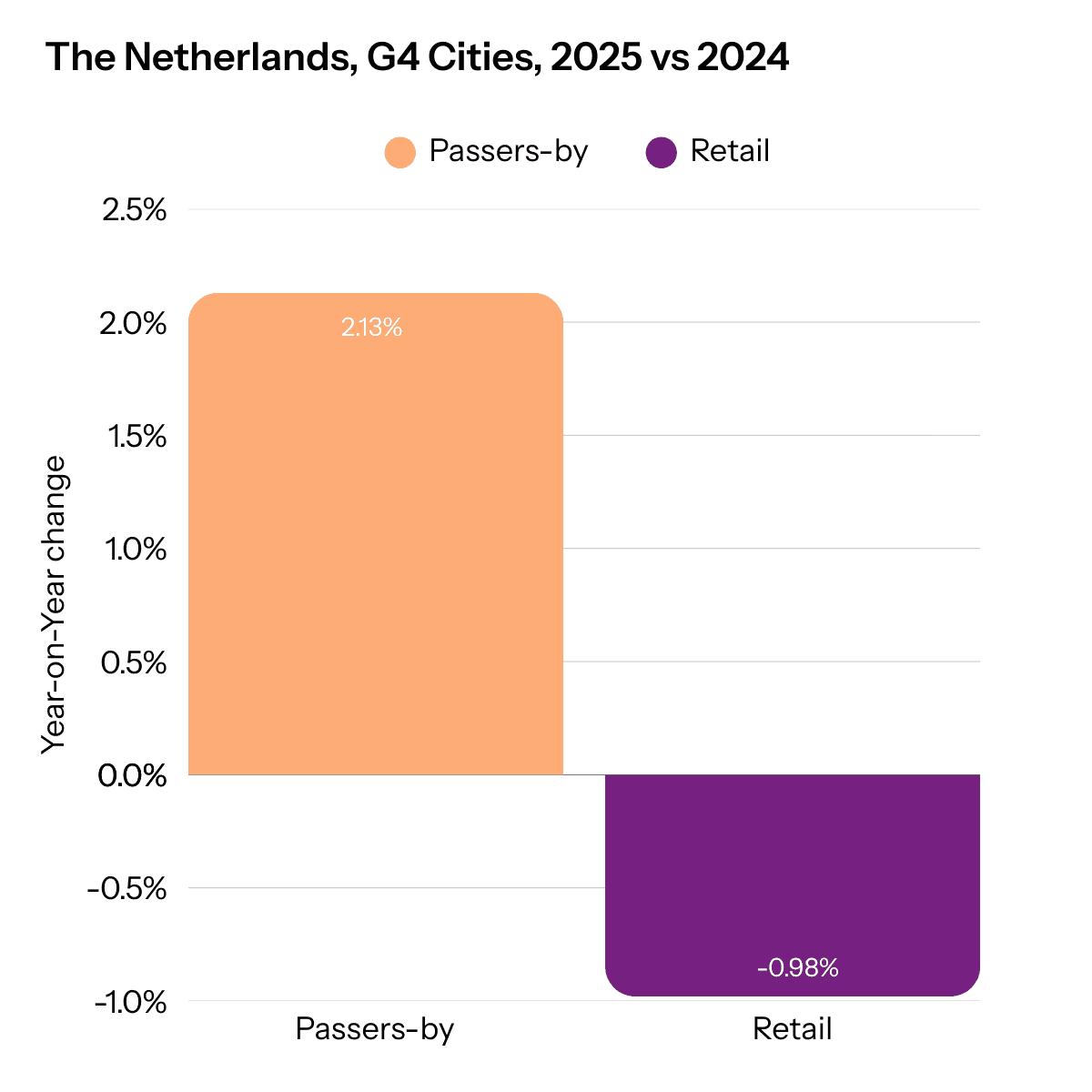

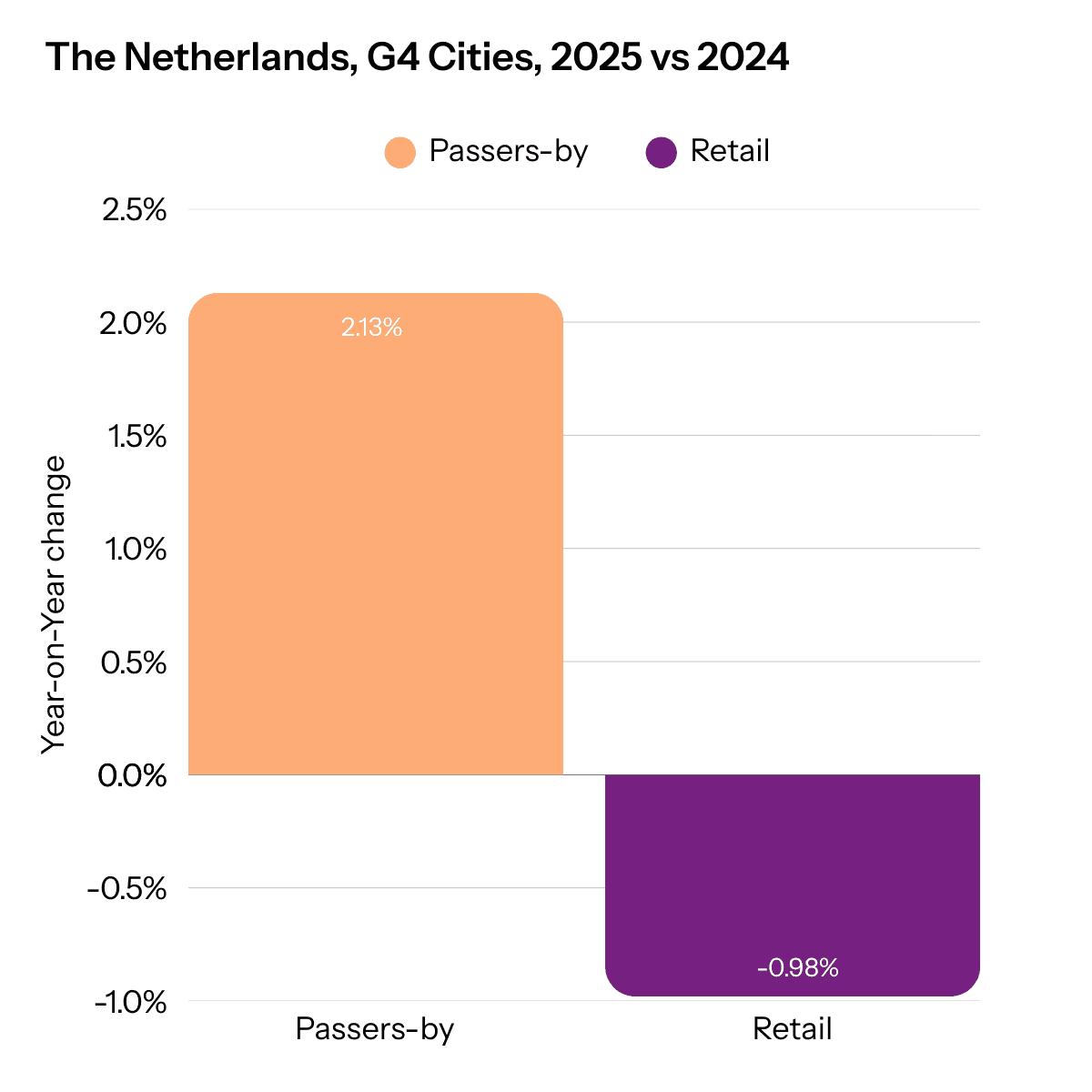

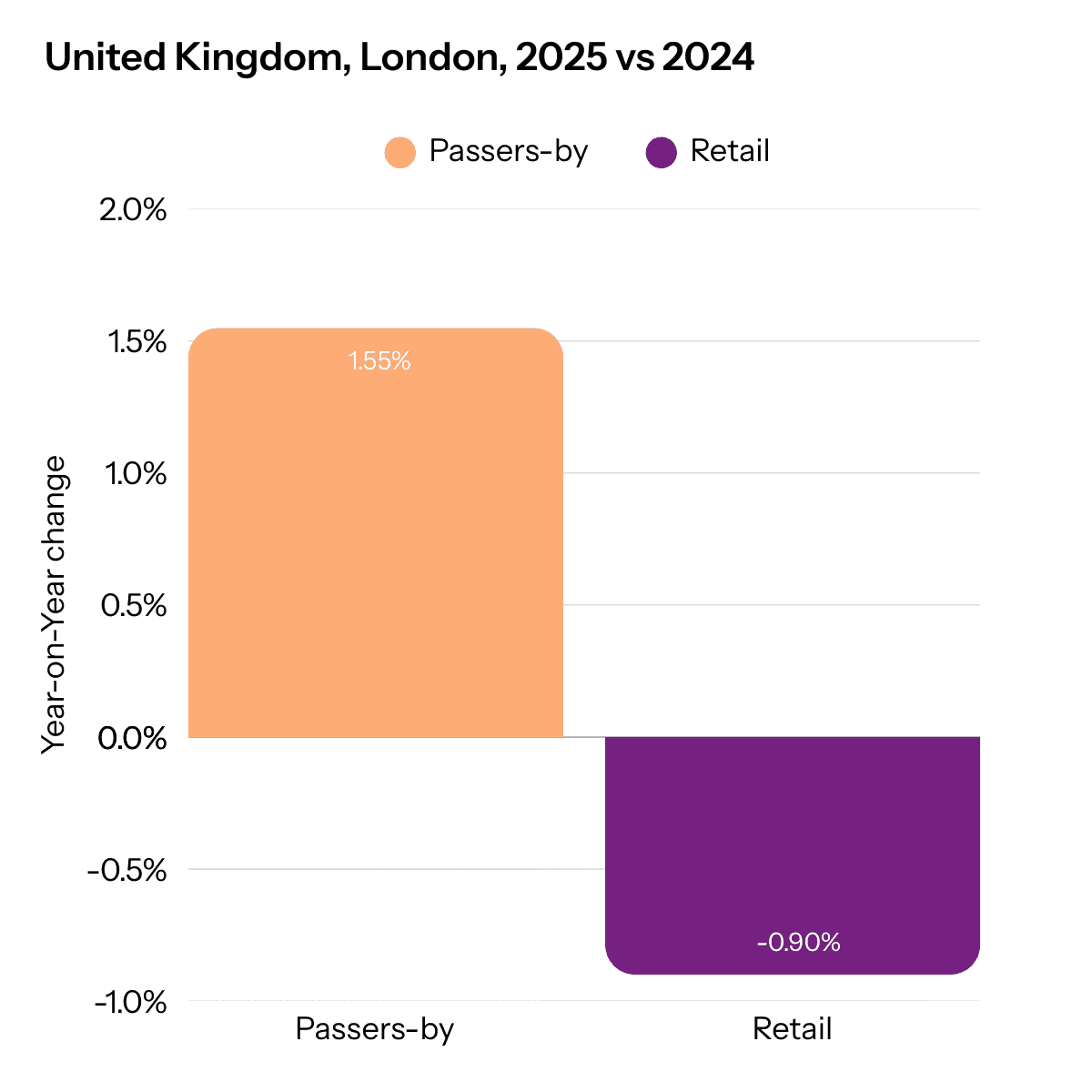

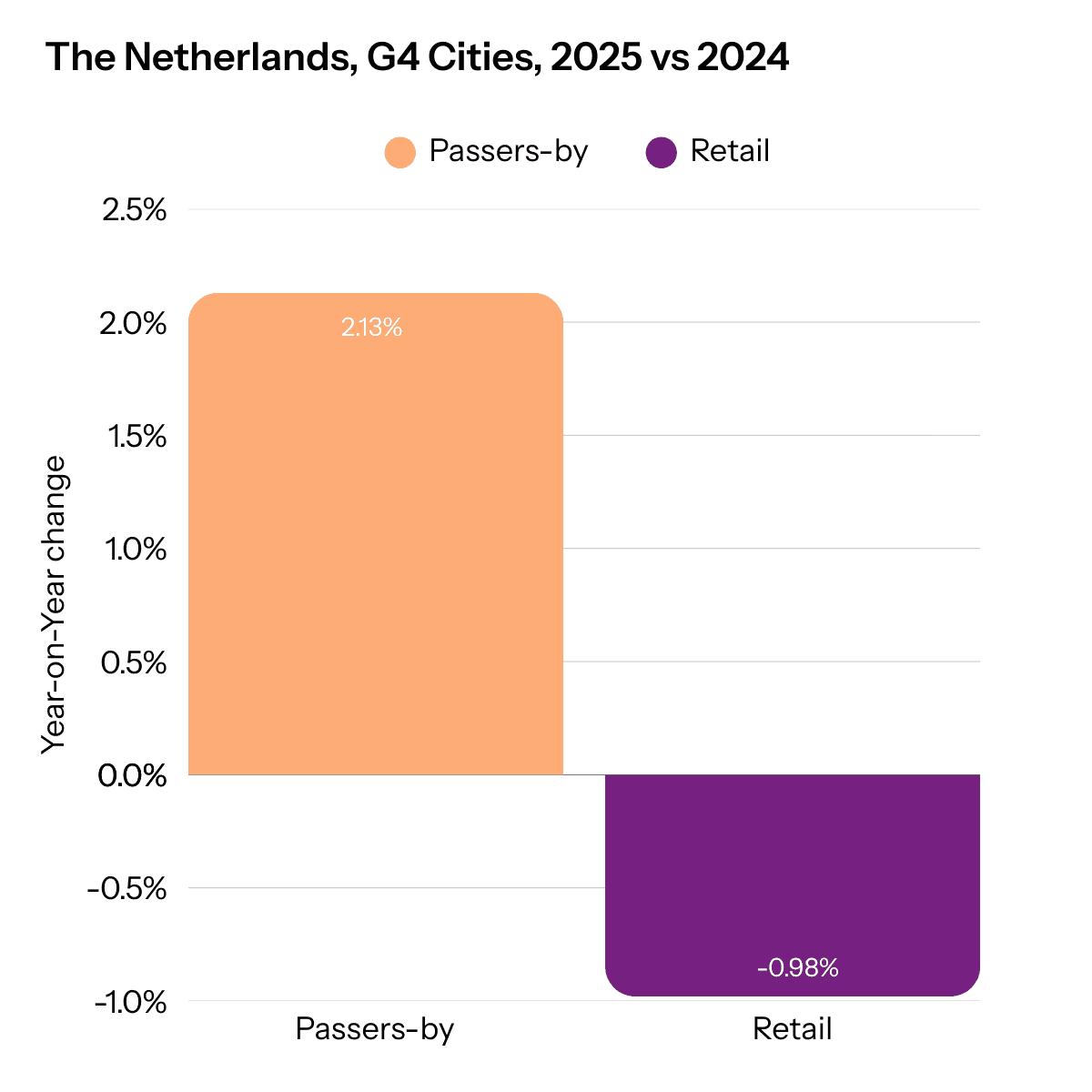

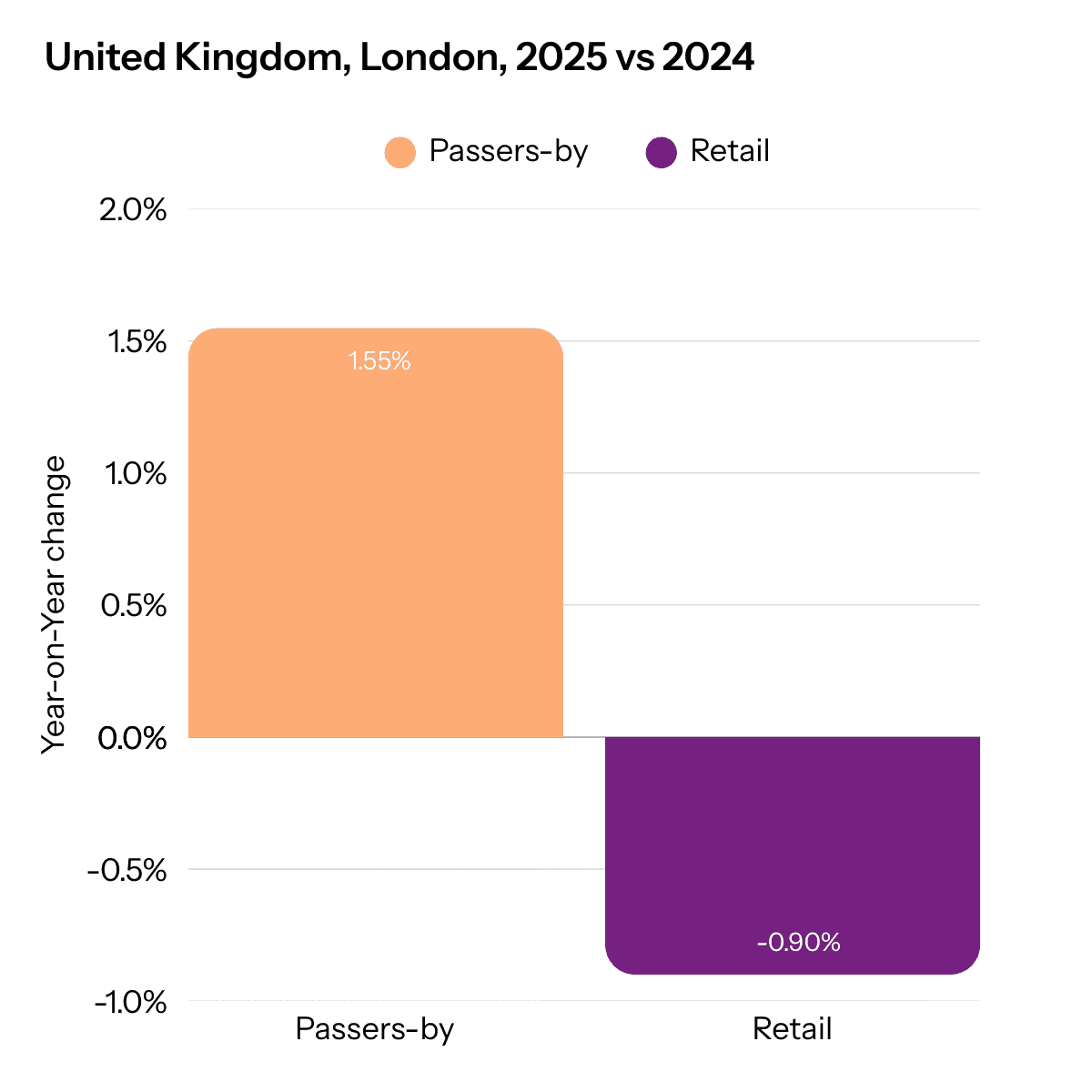

Major urban centres continued to draw strong visitor numbers in 2025. In the Netherlands, the four largest cities recorded passer-by growth of +2.13%, while London once again outperformed the UK average, driven by tourism, office return and leisure activity.

However, this growth did not consistently translate into retail visits. Retail visits in the Dutch G4 declined by -0.98%, and London showed weaker conversion into retail visits compared with other UK destinations.

This pattern highlights growing conversion challenges in large city centres, where visits are increasingly driven by non-retail purposes such as work, tourism and hospitality.

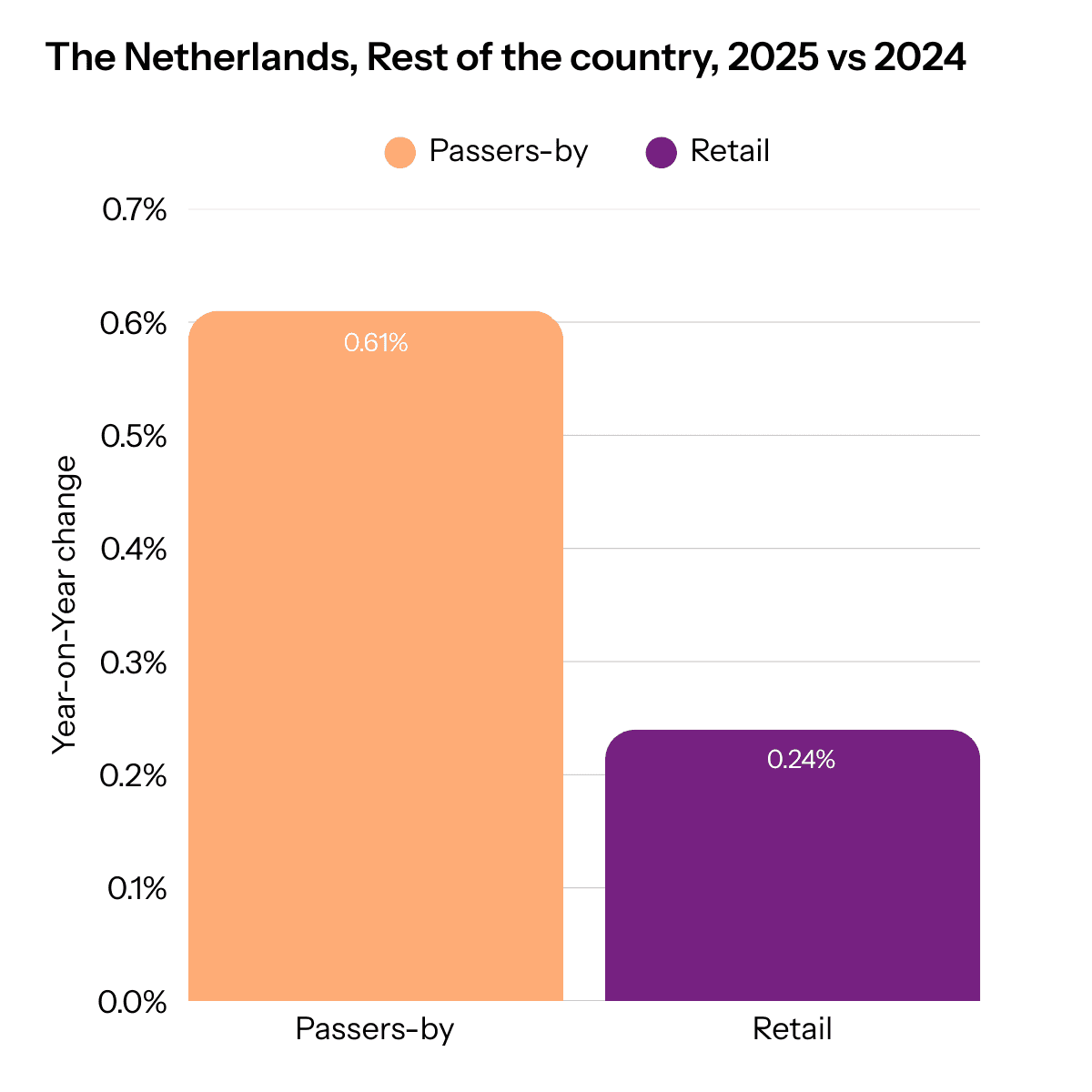

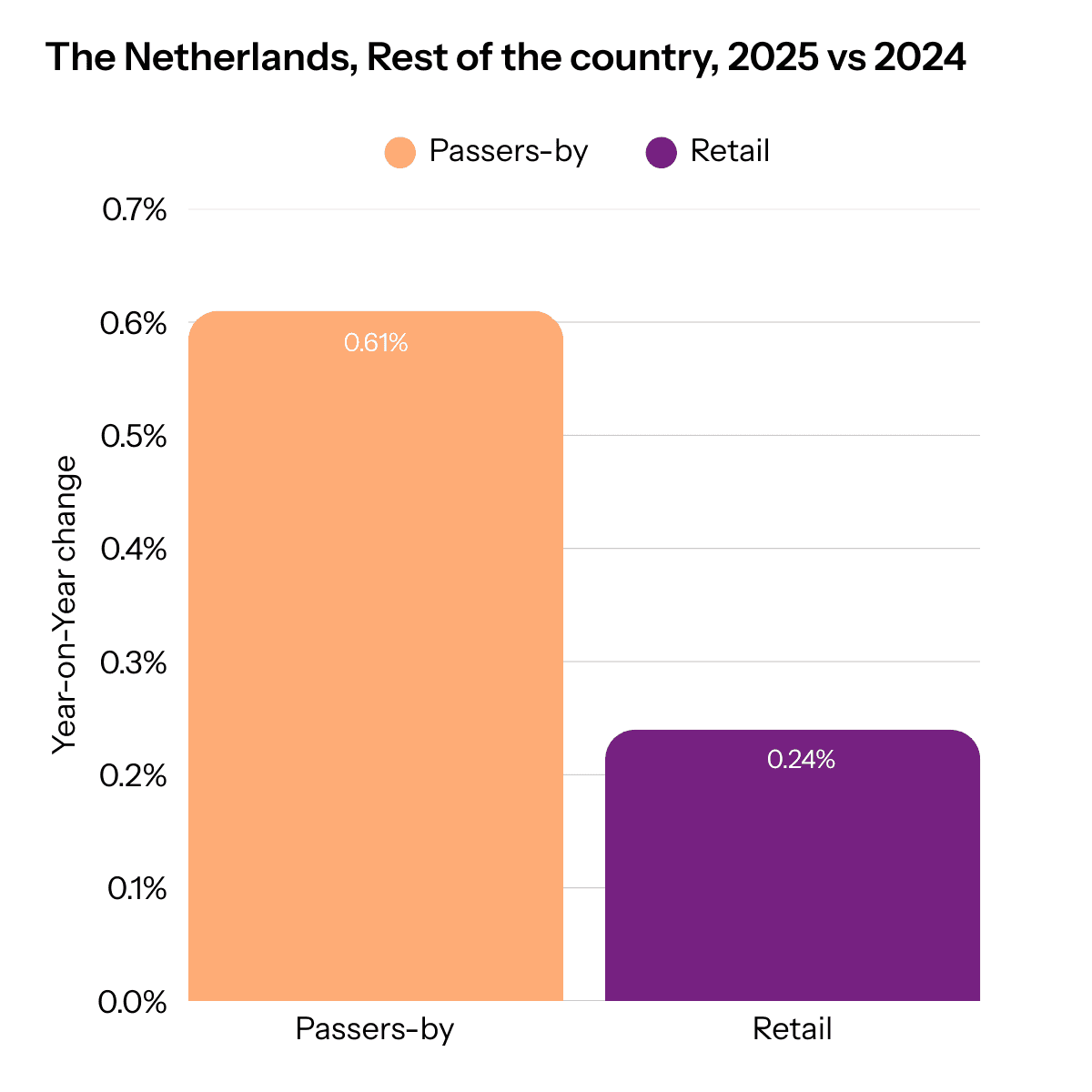

Convenience-led destinations gain ground

Growth in 2025 was more resilient outside the largest city centres. In the Netherlands, neighbourhood and district centres performed strongest, with footfall growth of +2.5% and +2.6% respectively, reflecting their role in daily consumer routines.

In the UK, shopping centres (+2.2%) and high streets (+2.1%) led growth, supported by improved tenant mix, food and beverage and experiential retail. Retail parks (-0.3%) and standalone stores (-0.1%) continued to underperform, reflecting pressure from online alternatives and increasingly mission-led shopping behaviour.

Across markets, shopping centres consistently outperformed individual stores, reinforcing their position as integrated destinations where retail, services, hospitality and leisure converge.

5 key takeaways from the Footfall Trend Report 2025

Growth has stabilised

Footfall remains positive but modest, signalling a shift from recovery to mature market conditions.Presence and conversion are diverging

Passer-by volumes are rising faster than retail visits, making conversion quality more important than raw footfall.Big cities face growing conversion challenges

High visitor numbers do not automatically translate into retail engagement in major urban centres.Convenience-led destinations outperform

Local, district and well-managed shopping destinations aligned with daily routines show the strongest growth.Experience and relevance define performance

Destinations that combine retail, services, food and leisure continue to outperform single-purpose formats.

Looking ahead to 2026

Looking ahead, PFM Intelligence expects low-growth conditions to persist across European retail markets in 2026. Success will be shaped less by scale or centrality and more by asset quality, accessibility, conversion and relevance.

As markets move further beyond recovery, destinations that actively adapt to changing consumer behaviour and focus on experience-led value creation will be best positioned to outperform.

“Retail growth in 2025 was no longer about attracting as many people as possible,” says Wendy Hulshof-Hoven, Head of Data & Insights at PFM Intelligence. “Our data shows that consumers are more selective, more purposeful and increasingly focused on convenience and experience. Destinations that align with everyday behaviour and actively manage conversion will be the ones that continue to perform in a low-growth environment.”

Physical retail across Europe entered a new phase of maturity in 2025. Following the strong post-pandemic rebound of recent years, growth stabilised, visitor behaviour continued to evolve and performance became increasingly defined by conversion, convenience and experience, rather than sheer footfall volumes.

These insights come from PFM Intelligence’s Footfall Trend Report 2025, based on anonymised sensor data covering more than 3 billion people across over 2,000 retail and leisure locations in the Netherlands, the United Kingdom and multiple other European markets. By analysing real-world movement data rather than surveys or transactions, the report provides an objective view of how consumers actually use physical destinations.

Footfall stabilises as consumer behaviour shifts

Across both the Netherlands and the UK, total footfall growth remained positive but modest in 2025. In the Netherlands, national footfall increased by 0.50% year-on-year, while the UK recorded a 0.27% increase, signalling a clear shift from recovery to stabilisation.

In both markets, passer-by volumes grew faster than retail visits, underlining a widening gap between presence and conversion. Passers-by increased by 0.8% in the Netherlands and 0.55% in the UK, while retail visits were flat to marginally positive (-0.04% in the Netherlands, +0.16% in the UK).

This divergence points to a structural change in shopping behaviour. Consumers remain active in physical environments, but they visit stores less frequently and with clearer intent, often combining shopping with work, leisure or daily routines. Convenience, proximity and multifunctional destinations are playing an increasingly decisive role.

Big cities attract footfall, but conversion comes under pressure

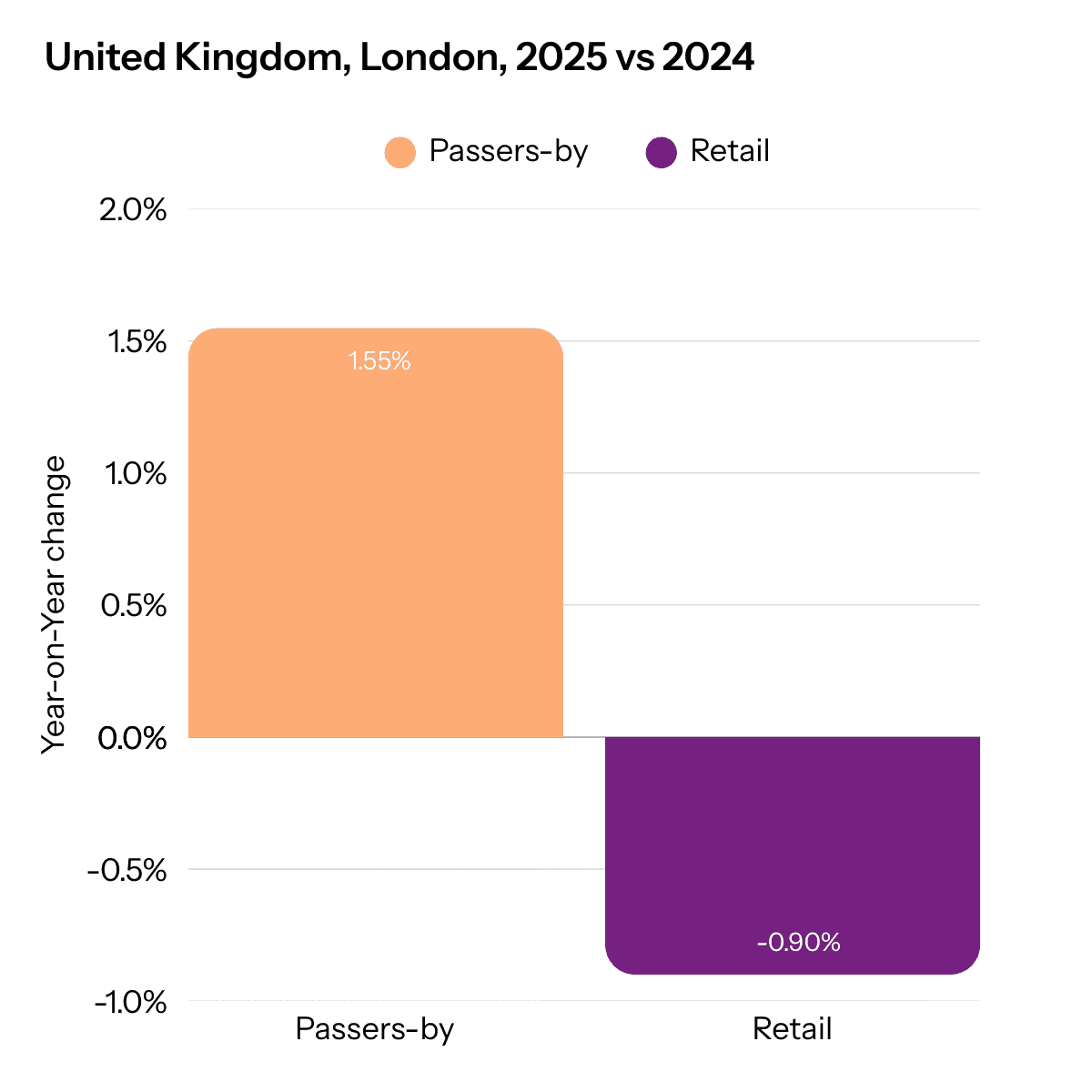

Major urban centres continued to draw strong visitor numbers in 2025. In the Netherlands, the four largest cities recorded passer-by growth of +2.13%, while London once again outperformed the UK average, driven by tourism, office return and leisure activity.

However, this growth did not consistently translate into retail visits. Retail visits in the Dutch G4 declined by -0.98%, and London showed weaker conversion into retail visits compared with other UK destinations.

This pattern highlights growing conversion challenges in large city centres, where visits are increasingly driven by non-retail purposes such as work, tourism and hospitality.

Convenience-led destinations gain ground

Growth in 2025 was more resilient outside the largest city centres. In the Netherlands, neighbourhood and district centres performed strongest, with footfall growth of +2.5% and +2.6% respectively, reflecting their role in daily consumer routines.

In the UK, shopping centres (+2.2%) and high streets (+2.1%) led growth, supported by improved tenant mix, food and beverage and experiential retail. Retail parks (-0.3%) and standalone stores (-0.1%) continued to underperform, reflecting pressure from online alternatives and increasingly mission-led shopping behaviour.

Across markets, shopping centres consistently outperformed individual stores, reinforcing their position as integrated destinations where retail, services, hospitality and leisure converge.

5 key takeaways from the Footfall Trend Report 2025

Growth has stabilised

Footfall remains positive but modest, signalling a shift from recovery to mature market conditions.Presence and conversion are diverging

Passer-by volumes are rising faster than retail visits, making conversion quality more important than raw footfall.Big cities face growing conversion challenges

High visitor numbers do not automatically translate into retail engagement in major urban centres.Convenience-led destinations outperform

Local, district and well-managed shopping destinations aligned with daily routines show the strongest growth.Experience and relevance define performance

Destinations that combine retail, services, food and leisure continue to outperform single-purpose formats.

Looking ahead to 2026

Looking ahead, PFM Intelligence expects low-growth conditions to persist across European retail markets in 2026. Success will be shaped less by scale or centrality and more by asset quality, accessibility, conversion and relevance.

As markets move further beyond recovery, destinations that actively adapt to changing consumer behaviour and focus on experience-led value creation will be best positioned to outperform.

“Retail growth in 2025 was no longer about attracting as many people as possible,” says Wendy Hulshof-Hoven, Head of Data & Insights at PFM Intelligence. “Our data shows that consumers are more selective, more purposeful and increasingly focused on convenience and experience. Destinations that align with everyday behaviour and actively manage conversion will be the ones that continue to perform in a low-growth environment.”

Physical retail across Europe entered a new phase of maturity in 2025. Following the strong post-pandemic rebound of recent years, growth stabilised, visitor behaviour continued to evolve and performance became increasingly defined by conversion, convenience and experience, rather than sheer footfall volumes.

These insights come from PFM Intelligence’s Footfall Trend Report 2025, based on anonymised sensor data covering more than 3 billion people across over 2,000 retail and leisure locations in the Netherlands, the United Kingdom and multiple other European markets. By analysing real-world movement data rather than surveys or transactions, the report provides an objective view of how consumers actually use physical destinations.

Footfall stabilises as consumer behaviour shifts

Across both the Netherlands and the UK, total footfall growth remained positive but modest in 2025. In the Netherlands, national footfall increased by 0.50% year-on-year, while the UK recorded a 0.27% increase, signalling a clear shift from recovery to stabilisation.

In both markets, passer-by volumes grew faster than retail visits, underlining a widening gap between presence and conversion. Passers-by increased by 0.8% in the Netherlands and 0.55% in the UK, while retail visits were flat to marginally positive (-0.04% in the Netherlands, +0.16% in the UK).

This divergence points to a structural change in shopping behaviour. Consumers remain active in physical environments, but they visit stores less frequently and with clearer intent, often combining shopping with work, leisure or daily routines. Convenience, proximity and multifunctional destinations are playing an increasingly decisive role.

Big cities attract footfall, but conversion comes under pressure

Major urban centres continued to draw strong visitor numbers in 2025. In the Netherlands, the four largest cities recorded passer-by growth of +2.13%, while London once again outperformed the UK average, driven by tourism, office return and leisure activity.

However, this growth did not consistently translate into retail visits. Retail visits in the Dutch G4 declined by -0.98%, and London showed weaker conversion into retail visits compared with other UK destinations.

This pattern highlights growing conversion challenges in large city centres, where visits are increasingly driven by non-retail purposes such as work, tourism and hospitality.

Convenience-led destinations gain ground

Growth in 2025 was more resilient outside the largest city centres. In the Netherlands, neighbourhood and district centres performed strongest, with footfall growth of +2.5% and +2.6% respectively, reflecting their role in daily consumer routines.

In the UK, shopping centres (+2.2%) and high streets (+2.1%) led growth, supported by improved tenant mix, food and beverage and experiential retail. Retail parks (-0.3%) and standalone stores (-0.1%) continued to underperform, reflecting pressure from online alternatives and increasingly mission-led shopping behaviour.

Across markets, shopping centres consistently outperformed individual stores, reinforcing their position as integrated destinations where retail, services, hospitality and leisure converge.

5 key takeaways from the Footfall Trend Report 2025

Growth has stabilised

Footfall remains positive but modest, signalling a shift from recovery to mature market conditions.Presence and conversion are diverging

Passer-by volumes are rising faster than retail visits, making conversion quality more important than raw footfall.Big cities face growing conversion challenges

High visitor numbers do not automatically translate into retail engagement in major urban centres.Convenience-led destinations outperform

Local, district and well-managed shopping destinations aligned with daily routines show the strongest growth.Experience and relevance define performance

Destinations that combine retail, services, food and leisure continue to outperform single-purpose formats.

Looking ahead to 2026

Looking ahead, PFM Intelligence expects low-growth conditions to persist across European retail markets in 2026. Success will be shaped less by scale or centrality and more by asset quality, accessibility, conversion and relevance.

As markets move further beyond recovery, destinations that actively adapt to changing consumer behaviour and focus on experience-led value creation will be best positioned to outperform.

“Retail growth in 2025 was no longer about attracting as many people as possible,” says Wendy Hulshof-Hoven, Head of Data & Insights at PFM Intelligence. “Our data shows that consumers are more selective, more purposeful and increasingly focused on convenience and experience. Destinations that align with everyday behaviour and actively manage conversion will be the ones that continue to perform in a low-growth environment.”

Coming soon!

Our Footfall Report 2025 is going to launch very soon!

Sign up here to pre-order our latest report to be the first to receive all data on your doorstep!

Coming soon!

Our Footfall Report 2025 is going to launch very soon!

Sign up here to pre-order our latest report to be the first to receive all data on your doorstep!

Coming soon!

Our Footfall Report 2025 is going to launch very soon!

Sign up here to pre-order our latest report to be the first to receive all data on your doorstep!